Crude Oil Futures: Scope for further gains – by pabspiovano Oil Commodities Energy OpenInterest Futures

beginning of the week, now by around 11.6K contracts. In the same direction, volume shrank for the third session in a row, this time by around 208.5K contracts.prices kicked off the new trading week on the back foot amidst shrinking open interest and volume. Against that backdrop, the likelihood of further weakness appears diminished and could pave the way for a potential challenge of the June high near the $75.00 mark per barrel.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Crude Oil Futures: Corrective decline on the cardsOpen interest in crude oil futures markets dropped for the second session in a row on Friday, now by more than 10K contracts according to preliminary

Crude Oil Futures: Corrective decline on the cardsOpen interest in crude oil futures markets dropped for the second session in a row on Friday, now by more than 10K contracts according to preliminary

Baca lebih lajut »

WTI crude oil attracts buyers near the 73.30 areaWestern Texas Intermediate (WTI), the US crude oil benchmark, attracts some buyers near the $73.30 area during the Asian trading hours on Monday. WTI

WTI crude oil attracts buyers near the 73.30 areaWestern Texas Intermediate (WTI), the US crude oil benchmark, attracts some buyers near the $73.30 area during the Asian trading hours on Monday. WTI

Baca lebih lajut »

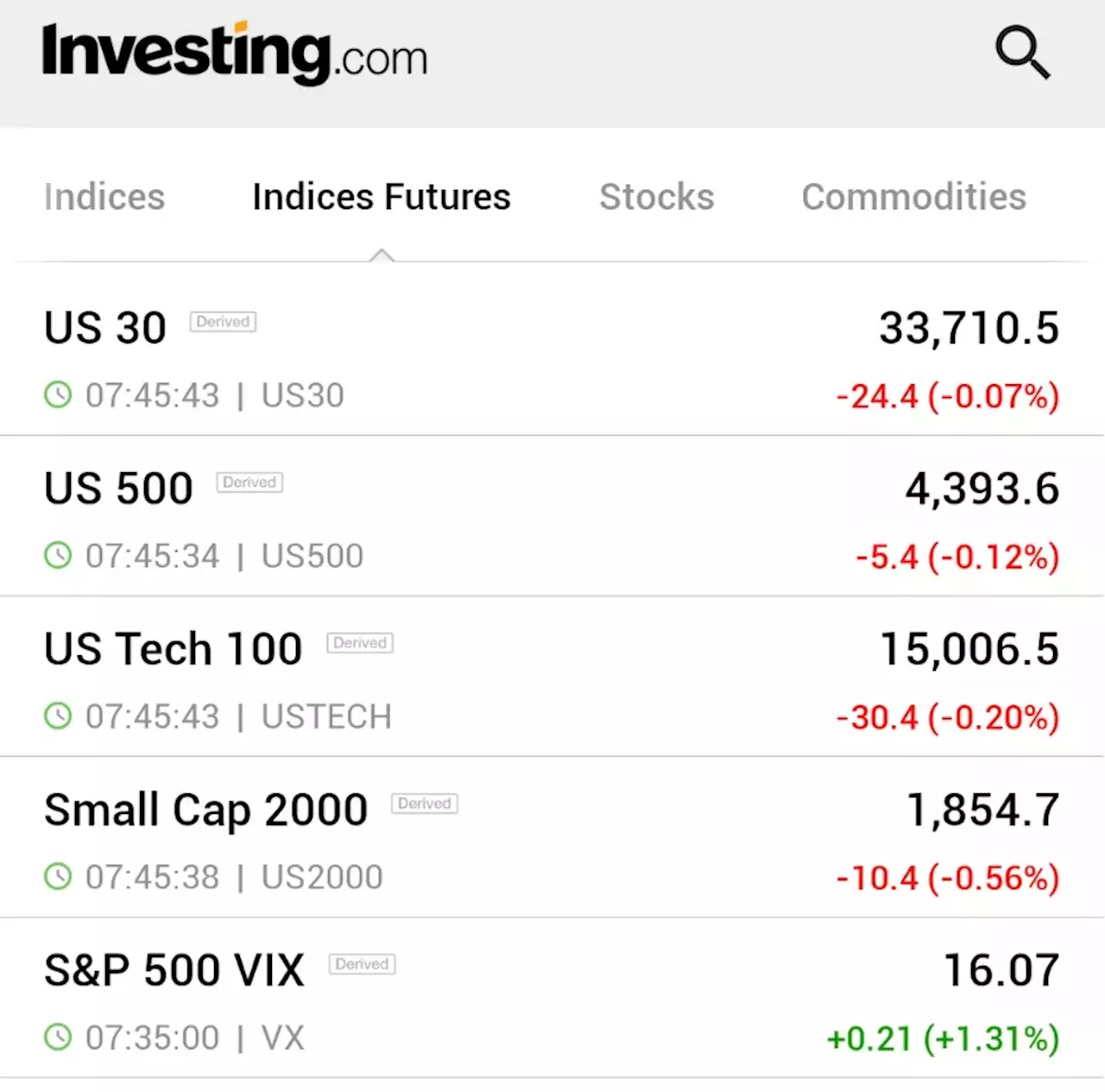

Dow futures tick higher, CPI data in focus By Investing.com⚠️BREAKING: *U.S. STOCK FUTURES TICK LOWER AS INVESTORS BRACE FOR BUSY WEEK $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Dow futures tick higher, CPI data in focus By Investing.com⚠️BREAKING: *U.S. STOCK FUTURES TICK LOWER AS INVESTORS BRACE FOR BUSY WEEK $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Baca lebih lajut »

Gold Futures: Further upside on the cardsCME Group’s flash data for gold futures markets noted traders added around 3.3K contracts to their open interest positions on Friday, adding to the on

Gold Futures: Further upside on the cardsCME Group’s flash data for gold futures markets noted traders added around 3.3K contracts to their open interest positions on Friday, adding to the on

Baca lebih lajut »

Natural Gas Futures: Further losses not ruled outConsidering advanced prints from CME Group for natural gas futures markets, open interest reversed the previous daily drop and increased by around 4.8

Natural Gas Futures: Further losses not ruled outConsidering advanced prints from CME Group for natural gas futures markets, open interest reversed the previous daily drop and increased by around 4.8

Baca lebih lajut »

U.S. stock futures retreat as inflation data and earnings season loomStock futures were lower as the poor sentiment of recent sessions remained.

U.S. stock futures retreat as inflation data and earnings season loomStock futures were lower as the poor sentiment of recent sessions remained.

Baca lebih lajut »