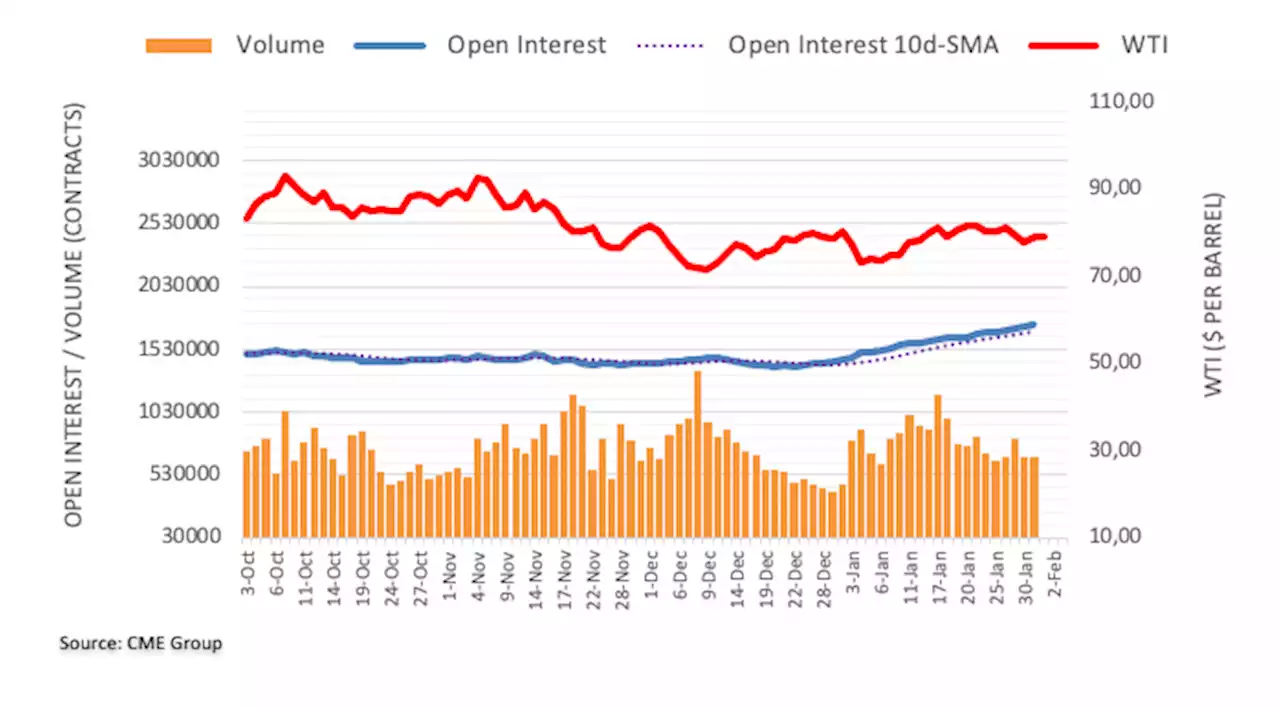

Crude Oil Futures: Further recovery appears likely Oil Commodities Energy OpenInterest Futures

WTI remains focused on $82.60charted a decent advance on Tuesday, coming back after dropping to 3-week lows near $76.60. The rebound was amidst increasing open interest and volume and is supportive of the continuation of the bounce at least in the very near term. Next on the upside for the commodity comes the YTD top at $82.60 per barrel .

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Crude Oil Futures: Door open to extra retracementCME Group’s flash data for crude oil futures markets noted traders added around 14.3K contracts to their open interest positions at the beginning of t

Crude Oil Futures: Door open to extra retracementCME Group’s flash data for crude oil futures markets noted traders added around 14.3K contracts to their open interest positions at the beginning of t

Baca lebih lajut »

Oil slips on rate hike worries, Russian crude flows despite China performanceOil prices extended losses on Tuesday as the threat of further interest rate increases and continued Russian crude flows cancelled out demand recovery expectations from China.

Oil slips on rate hike worries, Russian crude flows despite China performanceOil prices extended losses on Tuesday as the threat of further interest rate increases and continued Russian crude flows cancelled out demand recovery expectations from China.

Baca lebih lajut »

Oil slips on rate hike worries, Russian export flowsOil prices fell on Tuesday as the threat of further interest rate increases and ample Russian crude flows outweighed demand recovery expectations from China.

Oil slips on rate hike worries, Russian export flowsOil prices fell on Tuesday as the threat of further interest rate increases and ample Russian crude flows outweighed demand recovery expectations from China.

Baca lebih lajut »

Dow futures tick lower as investors brace for Fed, earnings By Investing.com⚠️BREAKING: *U.S. STOCK FUTURES POINT TO SHARPLY LOWER OPEN AS WALL STREET BRACES FOR FED RATE HIKE, BIG TECH EARNINGS $DIA $SPY $QQQ 🇺🇸🇺🇸

Dow futures tick lower as investors brace for Fed, earnings By Investing.com⚠️BREAKING: *U.S. STOCK FUTURES POINT TO SHARPLY LOWER OPEN AS WALL STREET BRACES FOR FED RATE HIKE, BIG TECH EARNINGS $DIA $SPY $QQQ 🇺🇸🇺🇸

Baca lebih lajut »

Dow futures drop 200 points as Fed decision, tech earnings awaitU.S. stock futures slumped on Monday to kick off a big week that features a Federal Reserve interest-rate decision, a jobs report and several key...

Dow futures drop 200 points as Fed decision, tech earnings awaitU.S. stock futures slumped on Monday to kick off a big week that features a Federal Reserve interest-rate decision, a jobs report and several key...

Baca lebih lajut »

Arbitrum-Based Vest Exchange Emerges, Aims to Democratize Perpetual Futures – Defi Bitcoin NewsThe creators of a new DEX platform built on the Arbitrum layer two blockchain announced on Jan. 28, 2023, that the project has emerged from stealth mode.

Arbitrum-Based Vest Exchange Emerges, Aims to Democratize Perpetual Futures – Defi Bitcoin NewsThe creators of a new DEX platform built on the Arbitrum layer two blockchain announced on Jan. 28, 2023, that the project has emerged from stealth mode.

Baca lebih lajut »