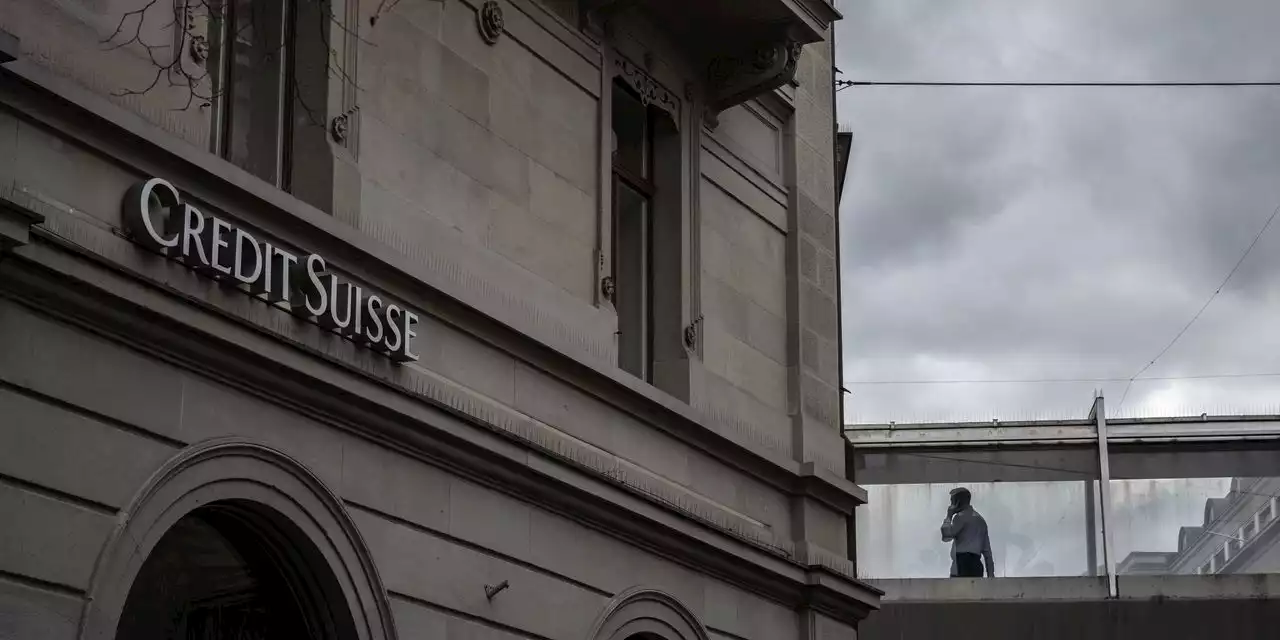

Credit Suisse whistleblowers say Swiss bank has been helping wealthy Americans dodge U.S. taxes

in a hastily arranged bailout earlier this month, may bring with it a fresh set of regulatory and legal problems for its new owner.

Senate Finance Committee Chairman Ron Wyden, D-Ore., said his committee had received new information just this week from Credit Suisse about additional American undisclosed accounts that the bank held after 2014. The two former Credit Suisse employees, who worked as whistleblowers with the U.S. government and Senate investigators, told CNBC some of the bad behavior continued long after Credit Suisse's 2014 plea agreement. CNBC agreed to mask their identities on camera and to maintain their anonymity because they say they fear retaliation from the bank. They were interviewed in the weeks before Credit Suisse collapsed earlier this month.

Senior executives would call out individual bankers at quarterly meetings where they would read out the asset numbers for each banker. If a banker's number declined, the second whistleblower said, "you'd get exposed in front of your colleagues." And as a result, he said, "there may come moments where people simply omit saying things."

"Swiss banks are much more expensive, and there's a reason for that," he said. "If you could choose anywhere in the world you want to be, why would you pay more? Why would you be in a place which underperforms in terms of your return on assets?" "I tried to reach you, congratulation!!!!!" their private banker emailed back. "This is a big step for you and I know it was not easy."

But aides say they didn't find any evidence the family ever filed required paperwork with the US government or paid taxes on their assets. Instead, the assets were held under one family member's dual Latin American passport.As a result, the aide said: "They're potentially in legal jeopardy, to put it mildly."

Former Justice Department prosecutor Jeffrey Neiman, who is representing the whistleblowers, said he believes fraud is still ongoing and DOJ should claw back hundreds of millions of dollars in fines that the bank agreed to pay in 2014, but ultimately didn't have to pay. The bank agreed to pay $2.6 billion, but a federal judge only imposed a penalty of $1.3 billion at the time.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Saudi National Bank chair resigns after Credit Suisse comments | CNN BusinessThe chairman of Credit Suisse’s largest shareholder, Saudi National Bank, has resigned less than two weeks after comments he made about the Swiss lender accelerated a plunge in its share price.

Saudi National Bank chair resigns after Credit Suisse comments | CNN BusinessThe chairman of Credit Suisse’s largest shareholder, Saudi National Bank, has resigned less than two weeks after comments he made about the Swiss lender accelerated a plunge in its share price.

Baca lebih lajut »

SNB chairman quits after his comments sparked Credit Suisse sell-offSaudi National Bank chairman quits after his comments sparked Credit Suisse turmoil — and $1 billion in losses for his company

Baca lebih lajut »

Breakingviews - Credit Suisse investor’s exit will zip some lipsThe fate of Saudi National Bank’s chairman may persuade other investors to maintain radio silence for a while. The lender on Monday said Ammar Al Khudairy resigned for personal reasons and will be replaced by current CEO Saeed Mohammed Al Ghamdi. The reshuffle comes less than two weeks after comments by Credit Suisse’s largest shareholder fuelled a panic by investors in the Swiss lender, prompting the government to orchestrate its cut-price rescue by rival UBS .

Breakingviews - Credit Suisse investor’s exit will zip some lipsThe fate of Saudi National Bank’s chairman may persuade other investors to maintain radio silence for a while. The lender on Monday said Ammar Al Khudairy resigned for personal reasons and will be replaced by current CEO Saeed Mohammed Al Ghamdi. The reshuffle comes less than two weeks after comments by Credit Suisse’s largest shareholder fuelled a panic by investors in the Swiss lender, prompting the government to orchestrate its cut-price rescue by rival UBS .

Baca lebih lajut »

UBS’s acquisition of Credit Suisse brings some good and bad for cryptoDespite negative macroeconomic developments, the crypto market performed well when news broke that UBS would take over Credit Suisse.

UBS’s acquisition of Credit Suisse brings some good and bad for cryptoDespite negative macroeconomic developments, the crypto market performed well when news broke that UBS would take over Credit Suisse.

Baca lebih lajut »

Chairman of Saudi National Bank, who sparked turmoil for Credit Suisse, resignsAmmar Al Khudairy, the chairman of Saudi National Bank, has resigned and will be replaced by the bank’s chief executive officer, Saeed Mohammed Al Ghamdi, the lender said in a statement.

Chairman of Saudi National Bank, who sparked turmoil for Credit Suisse, resignsAmmar Al Khudairy, the chairman of Saudi National Bank, has resigned and will be replaced by the bank’s chief executive officer, Saeed Mohammed Al Ghamdi, the lender said in a statement.

Baca lebih lajut »

Saudi National Bank chair resigns days after Credit Suisse comments sparked panicSaudi National Bank Chairman Ammar Al Khudairy is stepping down “due to personal reasons.”

Saudi National Bank chair resigns days after Credit Suisse comments sparked panicSaudi National Bank Chairman Ammar Al Khudairy is stepping down “due to personal reasons.”

Baca lebih lajut »