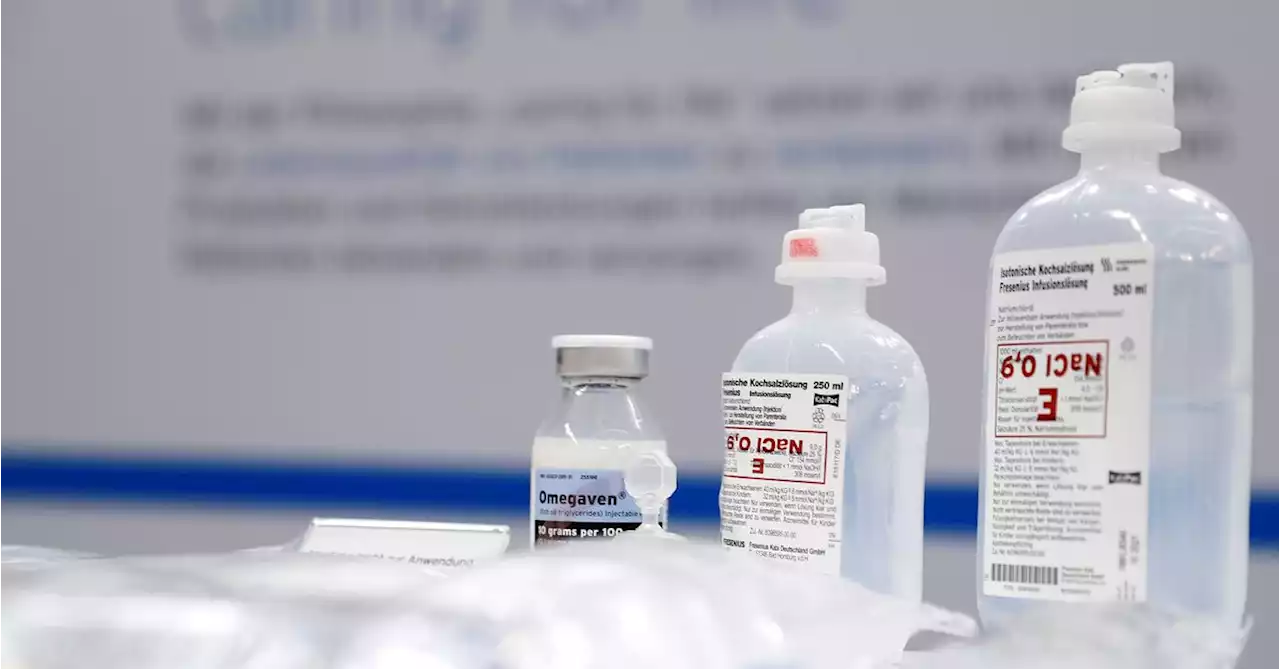

From Breakingviews - Fresenius takes tentative step on road to breakup

Fresenius currently controls the dialysis business and can appoint its board despite only owning a 32% stake, thanks to its arcane German legal structure. Changing the business to a traditional stock corporation will make the embattled unit more accountable to shareholders, and mean Chief Executive Michael Sen will no longer have to consolidate it in his accounts, a helpful change given the dialysis business regularly misses earnings expectations.

Further surgery looks likely. Sen will also hold Vamed, a hospital development business, as an investment, implying it could be sold. It’s worth 3 billion euros, Barclays analysts reckon. If Sen sells that unit as well as the 32% stake in Fresenius Medical Care, he will have 8 billion euros to cut debt or invest. His core intravenous drugs and hospital operating divisions should be worth 20 billion euros each, according to the UK bank.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Germany's Fresenius to simplify structure, flags potential profit fallGerman healthcare group Fresenius SE will slash costs and proceed with plans to cede strategic control over struggling dialysis group Fresenius Medical Care (FMC) as its new CEO seeks to simplify the diversified healthcare group, it said.

Germany's Fresenius to simplify structure, flags potential profit fallGerman healthcare group Fresenius SE will slash costs and proceed with plans to cede strategic control over struggling dialysis group Fresenius Medical Care (FMC) as its new CEO seeks to simplify the diversified healthcare group, it said.

Baca lebih lajut »

Breakingviews - Ukraine yet to make defence a safe investor havenThe West’s rush to supply weapons to war-torn Ukraine looks like a golden opportunity for defence companies to exit the ESG doghouse. Russia’s invasion and rising defence budgets are pushing some market players to engage with companies in the $485 billion military equipment industry that previously failed to pass muster on environmental, social and governance grounds. Despite pressing calls from President Volodymyr Zelenskiy for more tanks and missiles at last week’s Munich Security Conference, however, the sector will largely remain a no-go investment zone.

Breakingviews - Ukraine yet to make defence a safe investor havenThe West’s rush to supply weapons to war-torn Ukraine looks like a golden opportunity for defence companies to exit the ESG doghouse. Russia’s invasion and rising defence budgets are pushing some market players to engage with companies in the $485 billion military equipment industry that previously failed to pass muster on environmental, social and governance grounds. Despite pressing calls from President Volodymyr Zelenskiy for more tanks and missiles at last week’s Munich Security Conference, however, the sector will largely remain a no-go investment zone.

Baca lebih lajut »

Breakingviews - BHP investors aren’t seeing the wood for the treesMike Henry is becoming a transformation expert. Since taking over as boss of Australian miner BHP at the start of 2020, he has sold its most polluting units, including the oil and gas division and some coal assets, and is buying more energy-transition metals while being careful not to overpay. Meanwhile, he’s digging up good results in volatile markets. Yet shareholders don’t yet seem to appreciate the big shift underway.

Breakingviews - BHP investors aren’t seeing the wood for the treesMike Henry is becoming a transformation expert. Since taking over as boss of Australian miner BHP at the start of 2020, he has sold its most polluting units, including the oil and gas division and some coal assets, and is buying more energy-transition metals while being careful not to overpay. Meanwhile, he’s digging up good results in volatile markets. Yet shareholders don’t yet seem to appreciate the big shift underway.

Baca lebih lajut »

Breakingviews - Rolling EU debt would boost investment and marketsThe Covid-19 crisis prompted the European Union to turn to an instrument it had rarely used jointly: other people’s money. By promising nearly a trillion euros in new public borrowing, the 27-member bloc has become a big player in international capital markets.

Breakingviews - Rolling EU debt would boost investment and marketsThe Covid-19 crisis prompted the European Union to turn to an instrument it had rarely used jointly: other people’s money. By promising nearly a trillion euros in new public borrowing, the 27-member bloc has become a big player in international capital markets.

Baca lebih lajut »

Breakingviews - Hotels share revival shrugs off two crisesHotel groups are in restoration mode. Holiday Inn owner InterContinental said on Tuesday its operating profit from reportable segments soared 55% to $828 million in 2022 thanks to a revival in the U.S. market, customers taking longer holidays and its ability to hike prices. Chief Executive Keith Barr reckons the year ahead will continue to see strong demand, boosted by China’s re-opening.

Breakingviews - Hotels share revival shrugs off two crisesHotel groups are in restoration mode. Holiday Inn owner InterContinental said on Tuesday its operating profit from reportable segments soared 55% to $828 million in 2022 thanks to a revival in the U.S. market, customers taking longer holidays and its ability to hike prices. Chief Executive Keith Barr reckons the year ahead will continue to see strong demand, boosted by China’s re-opening.

Baca lebih lajut »

Breakingviews - Credit Suisse finds new genre of loose crisis talkThe conventional wisdom in banking is that there is no right way to respond when clients are pulling their money. Axel Lehmann is learning that lesson anew. Reuters reported on Monday that financial regulator Finma is reviewing remarks the Credit Suisse chair made in a punishing period late last year. He said in early December that outflows during October, mainly in wealth management, had “completely flattened out”, “partially reversed” and “basically stopped”. Fourth-quarter earnings, however, said they’d stabilised but not yet reversed.

Breakingviews - Credit Suisse finds new genre of loose crisis talkThe conventional wisdom in banking is that there is no right way to respond when clients are pulling their money. Axel Lehmann is learning that lesson anew. Reuters reported on Monday that financial regulator Finma is reviewing remarks the Credit Suisse chair made in a punishing period late last year. He said in early December that outflows during October, mainly in wealth management, had “completely flattened out”, “partially reversed” and “basically stopped”. Fourth-quarter earnings, however, said they’d stabilised but not yet reversed.

Baca lebih lajut »