Bitcoin’s rally to $72,000 is being driven by more than just spot BTC ETF inflows.

) increase of 7.6% between April 6 and April 8, reached an intraday peak of $72,747 and sparked widespread speculation about the underlying causes.exchange-traded funds as the primary factor, this perspective overlooks the broader motivations for buyers to push the price higher. It is more plausible that a range of macroeconomic factors played a key role in Bitcoin's recent price rally.

Investors' expectations regarding the economy and the cost of capital should not be underestimated. Periods of increased liquidity and monetary policies aimed at stimulating consumption and growth usually benefit scarce assets, a trend that is magnified during times of persistent inflation when salaries and prices rise to match the increasing availability of money.in a shareholder letter that the resilience of the U.S.

Moreover, escalating trade tensions between the U.S. and China could have spurred the increased interest in both gold and Bitcoin. Intriguingly,to a record high of $2,354 on April 8, a development that coincided with the U.S. Treasury 2-year yield reaching its highest level in over four months at 4.79%. Conventionally, gold's value tends to wane when investors favor the yields from fixed-income investments; however, this trend was conspicuously absent in the recent surge.

Within this context, the surge in Bitcoin's value to $72,000 on April 8 may be attributed to investors seeking a hedge against the deteriorating state of global economic relations and the ramifications of U.S. government stimulus initiatives, rather than being driven by sporadic and unpredictable Bitcoin inflows from specific investors.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.Bitcoin bulls nudge at $70K as BTC price sees 'not typical' weekend

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Cathie Wood’s Bitcoin ETF hits daily inflow record as BTC retests $72KThe ARK 21Shares Bitcoin ETF saw a surge in daily inflows on Wednesday, reaching a new record of $201.8 million, around five times its daily average.

Baca lebih lajut »

Spot Bitcoin ETF Flows Expected to Maintain Strength Ahead of Halving as BTC Taps $72KCrypto Blog

Spot Bitcoin ETF Flows Expected to Maintain Strength Ahead of Halving as BTC Taps $72KCrypto Blog

Baca lebih lajut »

Bitcoin whales copy classic bull market moves as BTC price eyes $72KBitcoin aims higher into the Easter weekend as BTC price momentum shakes off Coinbase nerves.

Baca lebih lajut »

Crypto Markets Add $100 Billion Daily as Bitcoin (BTC) Heads Toward $72K (Market Watch)Crypto Blog

Crypto Markets Add $100 Billion Daily as Bitcoin (BTC) Heads Toward $72K (Market Watch)Crypto Blog

Baca lebih lajut »

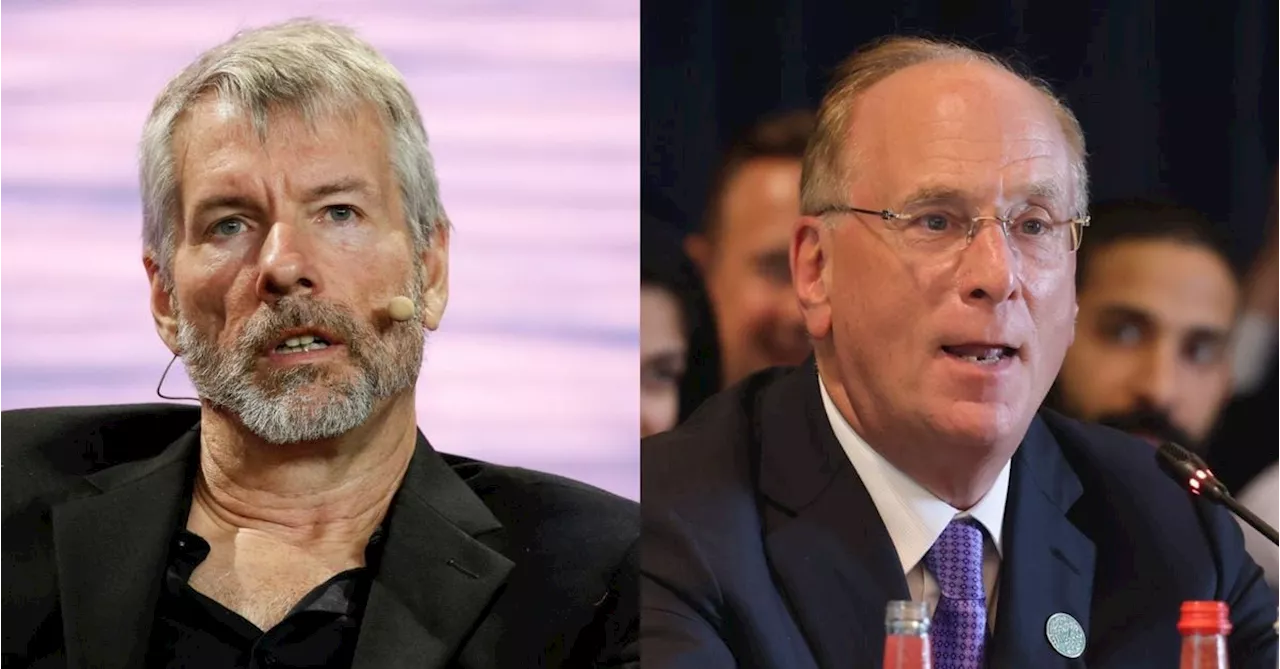

BlackRock's Bitcoin ETF Nears 200K BTC, Passing Michael Saylor's MicroStrategyHelene is a New York-based reporter covering Wall Street, the rise of the spot bitcoin ETFs and crypto exchanges. She is also the co-host of CoinDesk's Markets Daily show. Helene is a graduate of New York University's business and economic reporting program and has appeared on CBS News, YahooFinance and Nasdaq TradeTalks. She holds BTC and ETH.

BlackRock's Bitcoin ETF Nears 200K BTC, Passing Michael Saylor's MicroStrategyHelene is a New York-based reporter covering Wall Street, the rise of the spot bitcoin ETFs and crypto exchanges. She is also the co-host of CoinDesk's Markets Daily show. Helene is a graduate of New York University's business and economic reporting program and has appeared on CBS News, YahooFinance and Nasdaq TradeTalks. She holds BTC and ETH.

Baca lebih lajut »

BlackRock’s spot Bitcoin ETF amasses 250,000 BTC as Fidelity’s crosses $10 billion AUMMeanwhile, Ark Invest 21Shares’ ARKB spot Bitcoin ETF generated its best daily inflows of more than $200 million on Wednesday.

BlackRock’s spot Bitcoin ETF amasses 250,000 BTC as Fidelity’s crosses $10 billion AUMMeanwhile, Ark Invest 21Shares’ ARKB spot Bitcoin ETF generated its best daily inflows of more than $200 million on Wednesday.

Baca lebih lajut »