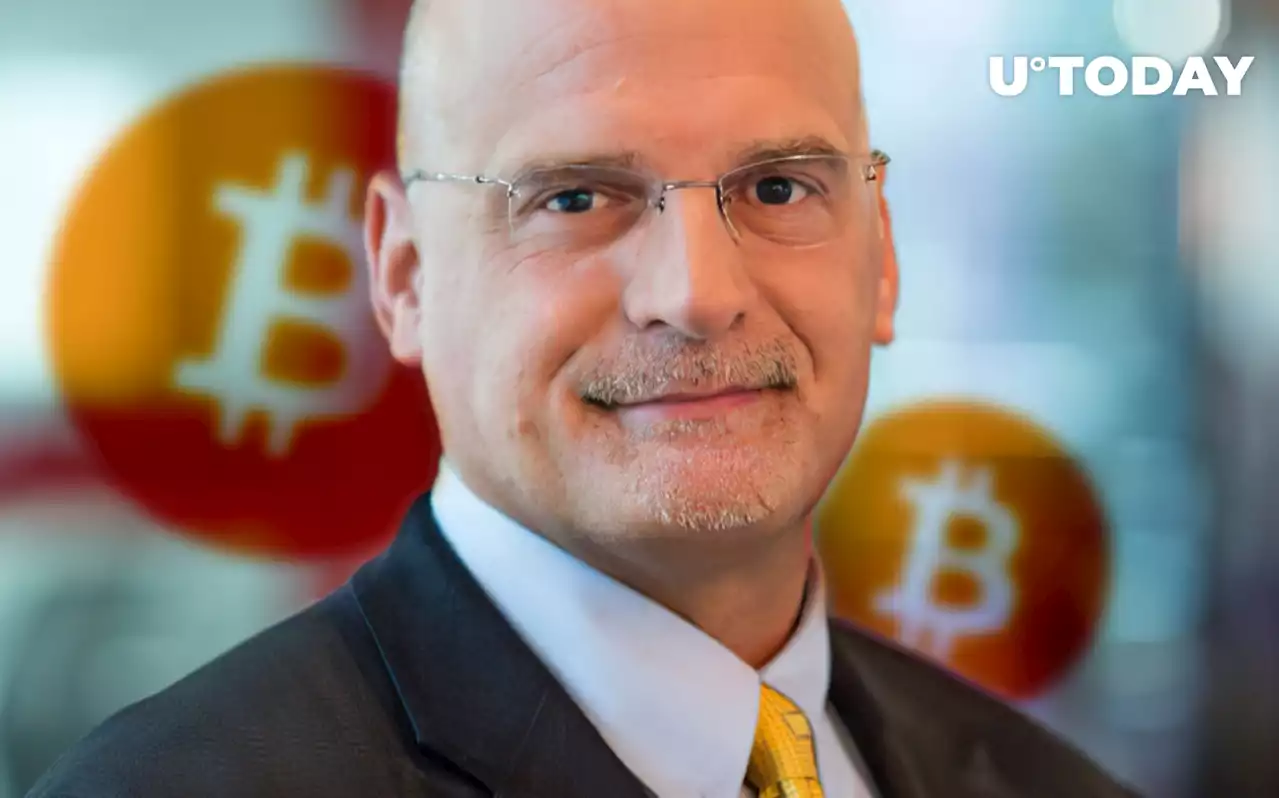

Bitcoin at $19,000 may signal an enduring bullmarket after a steep discount: mikemcglone11. $BTC

The screenshot from a recent Bloomberg report posted with the tweet, says that S&P 500 has dropped around 20 percent this month so far. While the traditional markets are following S&P on the way of the decline, the report points out that Bitcoin is building a base around the $19,000 price mark.

According to the report, a further fall of the S&P 500 price may stop further tightening policy of the Fed Reserve. Hence, the biggest “pump-and-dump” in the US money supply ever seen may prove Bitcoin as a store of value.Besides that, in an earlier tweet today, McGlone reminded the community that Bitcoin’s finite and diminishing supply is a key factor for its price to “continue to rise over time”.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Silver Price Analysis: XAG/USD eases below $19.00 inside weekly triangleSilver Price Analysis: XAG/USD eases below $19.00 inside weekly triangle – by anilpanchal7 Silver XAGUSD Technical Analysis Commodities SwingTrading

Silver Price Analysis: XAG/USD eases below $19.00 inside weekly triangleSilver Price Analysis: XAG/USD eases below $19.00 inside weekly triangle – by anilpanchal7 Silver XAGUSD Technical Analysis Commodities SwingTrading

Baca lebih lajut »

Silver Price Analysis: XAG/USD could slide back to retest $18.00 pivotal supportSilver Price Analysis: XAG/USD could slide back to retest $18.00 pivotal support – by hareshmenghani Silver Commodities Technical Analysis XAGUSD

Silver Price Analysis: XAG/USD could slide back to retest $18.00 pivotal supportSilver Price Analysis: XAG/USD could slide back to retest $18.00 pivotal support – by hareshmenghani Silver Commodities Technical Analysis XAGUSD

Baca lebih lajut »

Bitcoin's discount to hash rate highest since early 2020 — Mike McGloneBloomberg Intelligence senior commodity strategist Mike McGlone says it 'may be a matter of time' before Bitcoin returns to its propensity to outperform.

Bitcoin's discount to hash rate highest since early 2020 — Mike McGloneBloomberg Intelligence senior commodity strategist Mike McGlone says it 'may be a matter of time' before Bitcoin returns to its propensity to outperform.

Baca lebih lajut »

Bitcoin Price Should Continue to Rise, Bloomberg's Mike McGlone SaysMike McGlone, chief commodity strategist at Bloomberg Intelligence, still sees Bitcoin reaching $100,000 after predicting that it would hit that target in 2021

Bitcoin Price Should Continue to Rise, Bloomberg's Mike McGlone SaysMike McGlone, chief commodity strategist at Bloomberg Intelligence, still sees Bitcoin reaching $100,000 after predicting that it would hit that target in 2021

Baca lebih lajut »

S&P 500 Futures trace Wall Street’s gains to poke fortnight high, yields grind higherThe risk profile remains positive during the third consecutive day on early Wednesday even as a lack of major data/events restricts the market moves o

S&P 500 Futures trace Wall Street’s gains to poke fortnight high, yields grind higherThe risk profile remains positive during the third consecutive day on early Wednesday even as a lack of major data/events restricts the market moves o

Baca lebih lajut »