Bangko Sentral likely to keep rates unchanged—Moody’s unit READ MORE:

Moody’s Analytics which operates independently of Moody’s Investors Service said the central banks in the Philippines and Indonesia were expected to keep interest rates on hold due to lower inflation in the past months.

“Inflation began cooling more recently in the Philippines. After peaking at 8.7 percent year-on-year in January, inflation there eased to 6.1 percent in May,” Moody’s Analytics said. Hongkong and Shanghai Banking Corp. said in a previous report the Bangko Sentral ng Pilipinas might not be inclined to tweak its policy stance this week on continued robust economy coupled with the slowdown in inflation rate.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Investors looking to hold back ahead of BSP meetThe benchmark Philippine Stock Exchange index will continue a sideways trade, with near-term upside likely capped around the 6,600 level ahead of the Bangko Sentral ng Pilipinas’ policy meeting this week, according to an investment bank.

Investors looking to hold back ahead of BSP meetThe benchmark Philippine Stock Exchange index will continue a sideways trade, with near-term upside likely capped around the 6,600 level ahead of the Bangko Sentral ng Pilipinas’ policy meeting this week, according to an investment bank.

Baca lebih lajut »

BSP seen holding key policy rate steady at 6.25%The Bangko Sentral ng Pilipinas is expected to again keep its policy rate unchanged at 6.25 percent amid expectations of continually easing inflation, even as climate experts have declared the onset of El Niño that could push up prices of basic goods.

Baca lebih lajut »

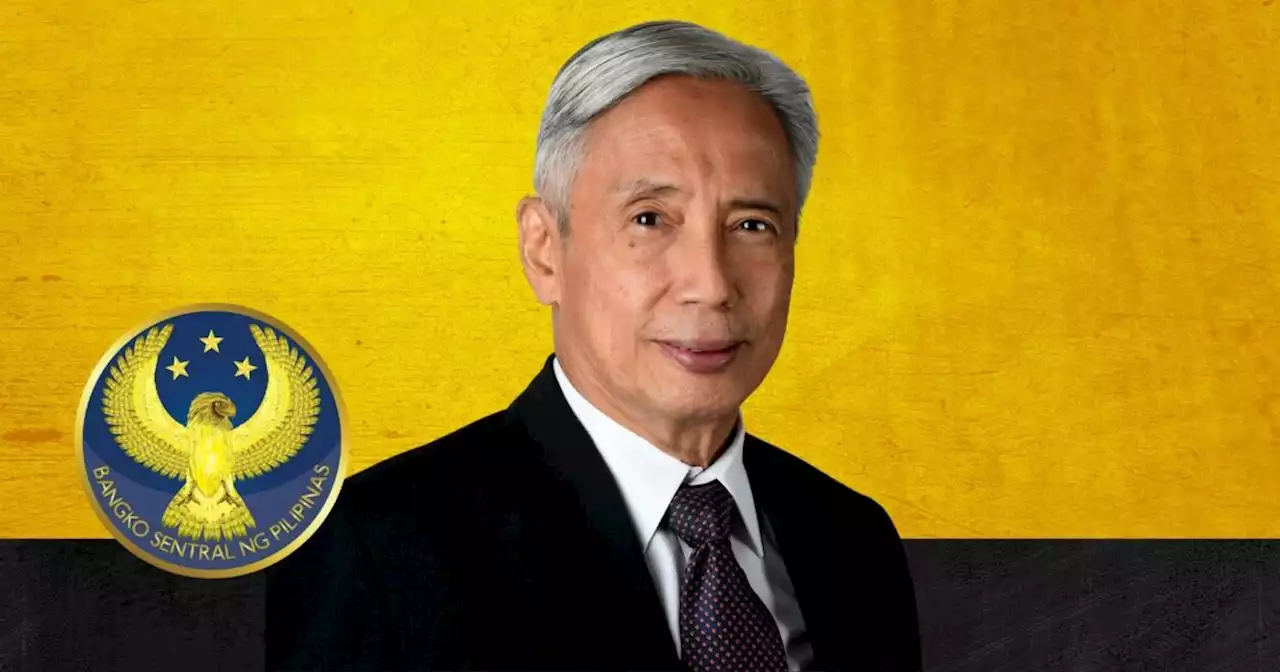

Medalla hints at continued rate hike pauseBangko Sentral ng Pilipinas Governor Felipe Medalla hinted at a continued pause on policy rate hikes this week, saying that the downtrend on inflation across the Philippines could justify this. | RonWDomingoINQ /PDI

Medalla hints at continued rate hike pauseBangko Sentral ng Pilipinas Governor Felipe Medalla hinted at a continued pause on policy rate hikes this week, saying that the downtrend on inflation across the Philippines could justify this. | RonWDomingoINQ /PDI

Baca lebih lajut »

BSP set to launch Coin Deposit Machine project at Robinsons ErmitaThe Bangko Sentral ng Pilipinas is set to launch Tuesday its Coin Deposit Machine project at Robinsons Ermita in Manila to promote coin recirculation, financial inclusion and digitalization. READ MORE:

BSP set to launch Coin Deposit Machine project at Robinsons ErmitaThe Bangko Sentral ng Pilipinas is set to launch Tuesday its Coin Deposit Machine project at Robinsons Ermita in Manila to promote coin recirculation, financial inclusion and digitalization. READ MORE:

Baca lebih lajut »

Easing in PHL monetary policy seen in Q1 2024 | Cai U. OrdinarioTHE recent decision of the United States Federal Reserve to maintain its interest rates is not enough assurance that rate cuts are coming, according to the Bangko Sentral ng Pilipinas (BSP). BSP Governor Felipe M. Medalla said that while yield curves are showing signs that the US Fed will cut…

Easing in PHL monetary policy seen in Q1 2024 | Cai U. OrdinarioTHE recent decision of the United States Federal Reserve to maintain its interest rates is not enough assurance that rate cuts are coming, according to the Bangko Sentral ng Pilipinas (BSP). BSP Governor Felipe M. Medalla said that while yield curves are showing signs that the US Fed will cut…

Baca lebih lajut »

End-March external debt up 6.8% to $119B | Cai U. OrdinarioTHE national government’s borrowings to augment its financing requirements for pandemic response and infrastructure programs, among others, increased the country’s external debt as of March 2023, according to the Bangko Sentral ng Pilipinas (BSP). In a statement, the BSP said the country’s external debt increased to $118.8 billion as of…

End-March external debt up 6.8% to $119B | Cai U. OrdinarioTHE national government’s borrowings to augment its financing requirements for pandemic response and infrastructure programs, among others, increased the country’s external debt as of March 2023, according to the Bangko Sentral ng Pilipinas (BSP). In a statement, the BSP said the country’s external debt increased to $118.8 billion as of…

Baca lebih lajut »