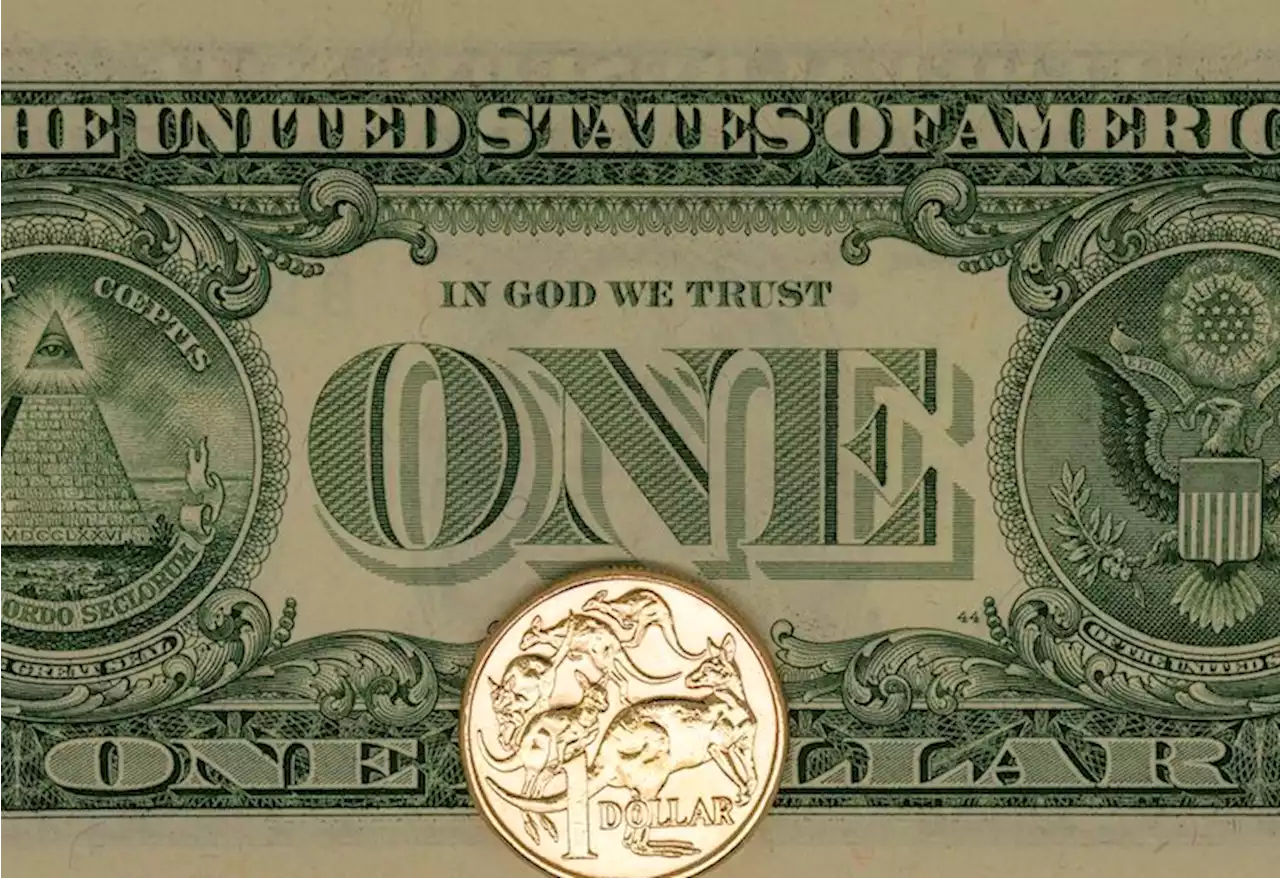

AUD/USD to trade modestly lower in 12M at 0.67 – Danske Bank AUDUSD China Fed Commodities Banks

have been a headwind. Economists at Danske Bank expect the AUD/USD pair to move gradually lower over the coming months.“We still think AUD is well positioned to gain support from Chinese reopening and the less negative global growth“Higher commodity prices are supportive for AUD all else equal, but they also increase the risk of the Fed turning more hawkish.”

“We continue to look for modestly lower AUD/USD in 12M in line with our view of broad USD strength, but AUD could still gain vis-à-vis other cyclically sensitive currencies, like EUR.”Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Pairs in Focus This Week \u2013 BTC/USD, EUR/USD, AUD/USDGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of February 12th, 2022 here.

Pairs in Focus This Week \u2013 BTC/USD, EUR/USD, AUD/USDGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of February 12th, 2022 here.

Baca lebih lajut »

AUD/USD pokes 0.6900 amid anxiety over unidentified objects, Fed, focus on US inflation, Aussie employmentAUD/USD pokes 0.6900 amid anxiety over unidentified objects, Fed, focus on US inflation, Aussie employment – by anilpanchal7 AUDUSD Inflation Employment Fed China

AUD/USD pokes 0.6900 amid anxiety over unidentified objects, Fed, focus on US inflation, Aussie employmentAUD/USD pokes 0.6900 amid anxiety over unidentified objects, Fed, focus on US inflation, Aussie employment – by anilpanchal7 AUDUSD Inflation Employment Fed China

Baca lebih lajut »

AUD/USD Price Analysis: Approaches H&S neckline below 0.6900The AUD/USD pair has shown a responsive buying action after surrendering the round-level support of 0.6900 in the Asian session. The Aussie asset has

AUD/USD Price Analysis: Approaches H&S neckline below 0.6900The AUD/USD pair has shown a responsive buying action after surrendering the round-level support of 0.6900 in the Asian session. The Aussie asset has

Baca lebih lajut »

AUD/USD bounces off multi-day low, climbs to 0.6925-30 region amid modest USD downtickAUD/USD bounces off multi-day low, climbs to 0.6925-30 region amid modest USD downtick – by hareshmenghani AUDUSD Fed Inflation Recession Currencies

AUD/USD bounces off multi-day low, climbs to 0.6925-30 region amid modest USD downtickAUD/USD bounces off multi-day low, climbs to 0.6925-30 region amid modest USD downtick – by hareshmenghani AUDUSD Fed Inflation Recession Currencies

Baca lebih lajut »

AUD/USD Price Analysis: Key support in play with eyes on 0.6900/50 for the opening rangeAUD/USD bears were unconvincing on Friday and we have seen little in the way of a commitment so far in the open on Monday, albeit in very early days i

AUD/USD Price Analysis: Key support in play with eyes on 0.6900/50 for the opening rangeAUD/USD bears were unconvincing on Friday and we have seen little in the way of a commitment so far in the open on Monday, albeit in very early days i

Baca lebih lajut »

Bank of America reveals the most undervalued stocks on Wall Street, including this motorcycle giantBank of America said this week that investors should buy these extremely undervalued stocks.

Bank of America reveals the most undervalued stocks on Wall Street, including this motorcycle giantBank of America said this week that investors should buy these extremely undervalued stocks.

Baca lebih lajut »