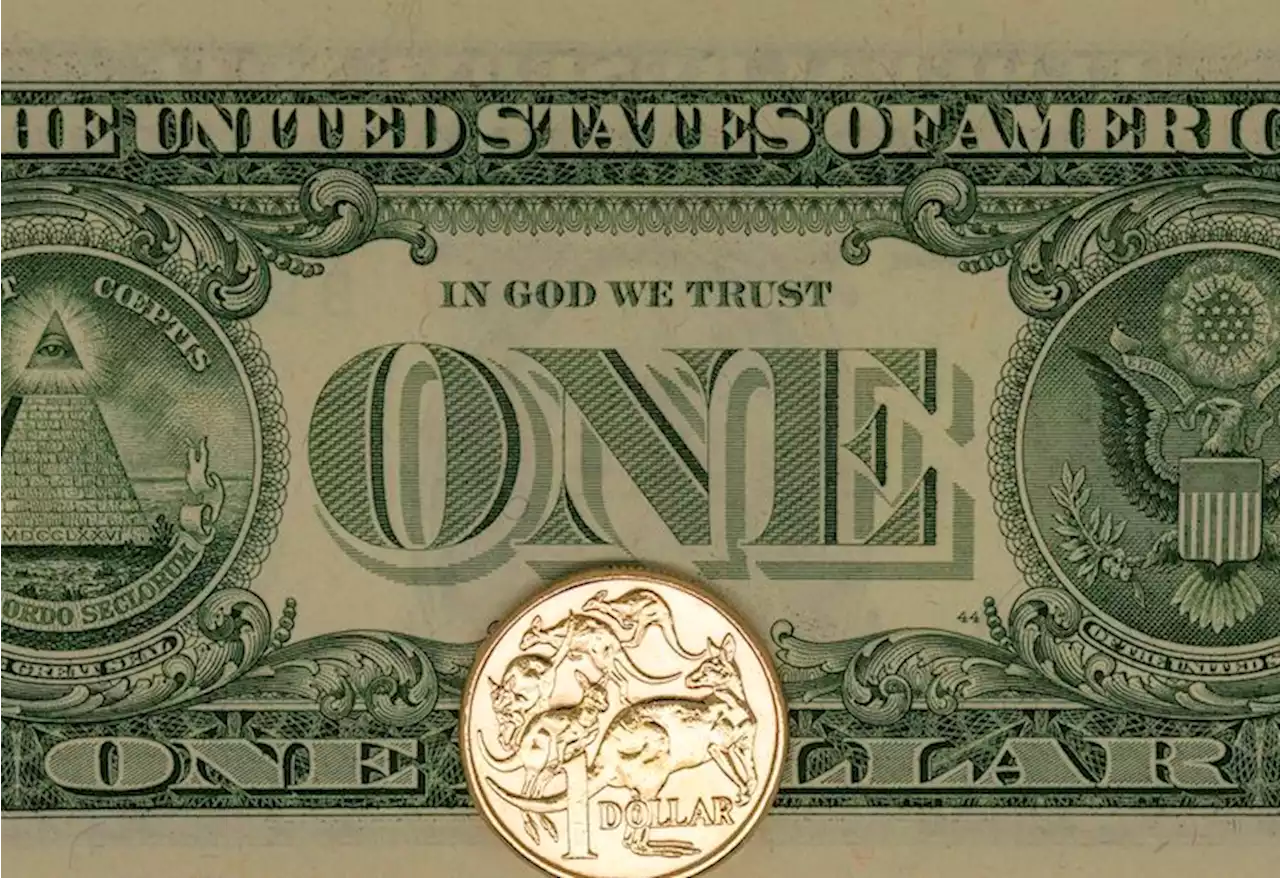

AUD/USD set to move higher in Q4 – CIBC AUDUSD Banks

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

AUD/USD prints unimpressive week-start below 0.6600, Australia/US inflation clues eyedAUD/USD kick-starts the inflation week with no major changes, making rounds to around 0.6570, while defending the last two days’ corrective bounce off

AUD/USD prints unimpressive week-start below 0.6600, Australia/US inflation clues eyedAUD/USD kick-starts the inflation week with no major changes, making rounds to around 0.6570, while defending the last two days’ corrective bounce off

Baca lebih lajut »

AUD/USD sticks to gains around 0.6580, bulls seem non-committed despite softer USDThe AUD/USD pair attracts some buying for the third successive day on Monday and trades around the 0.6580 region during the Asian session. This marks

AUD/USD sticks to gains around 0.6580, bulls seem non-committed despite softer USDThe AUD/USD pair attracts some buying for the third successive day on Monday and trades around the 0.6580 region during the Asian session. This marks

Baca lebih lajut »

AUD/USD posts modest gains around the 0.6570 mark, Australia/US inflation eyedThe AUD/USD pair kicks off the new week on a positive note and gains traction near 0.6575 during the Asian session on Monday. The uptick in the Aussie

AUD/USD posts modest gains around the 0.6570 mark, Australia/US inflation eyedThe AUD/USD pair kicks off the new week on a positive note and gains traction near 0.6575 during the Asian session on Monday. The uptick in the Aussie

Baca lebih lajut »

AUD/USD: Dwindling bets for a deeper pullback – UOBIn the view of Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group, the prospects for further decline in AUD/USD seems to be losi

AUD/USD: Dwindling bets for a deeper pullback – UOBIn the view of Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group, the prospects for further decline in AUD/USD seems to be losi

Baca lebih lajut »

AUD/USD Forecast: Long Position in Market Less AppealingAs an expert in the financial trading space, I am observing the market for signs of exhaustion that could potentially trigger a bearish move in the AUD

AUD/USD Forecast: Long Position in Market Less AppealingAs an expert in the financial trading space, I am observing the market for signs of exhaustion that could potentially trigger a bearish move in the AUD

Baca lebih lajut »

USD/CNH seen at 7.08 through Q3 and 6.85 through Q4 – CIBCPolicy beta to CNH should dissipate a bit, which suggests modest downside for USD/CNH in the near-term, economists at CIBC Capital Markets report. Big

USD/CNH seen at 7.08 through Q3 and 6.85 through Q4 – CIBCPolicy beta to CNH should dissipate a bit, which suggests modest downside for USD/CNH in the near-term, economists at CIBC Capital Markets report. Big

Baca lebih lajut »