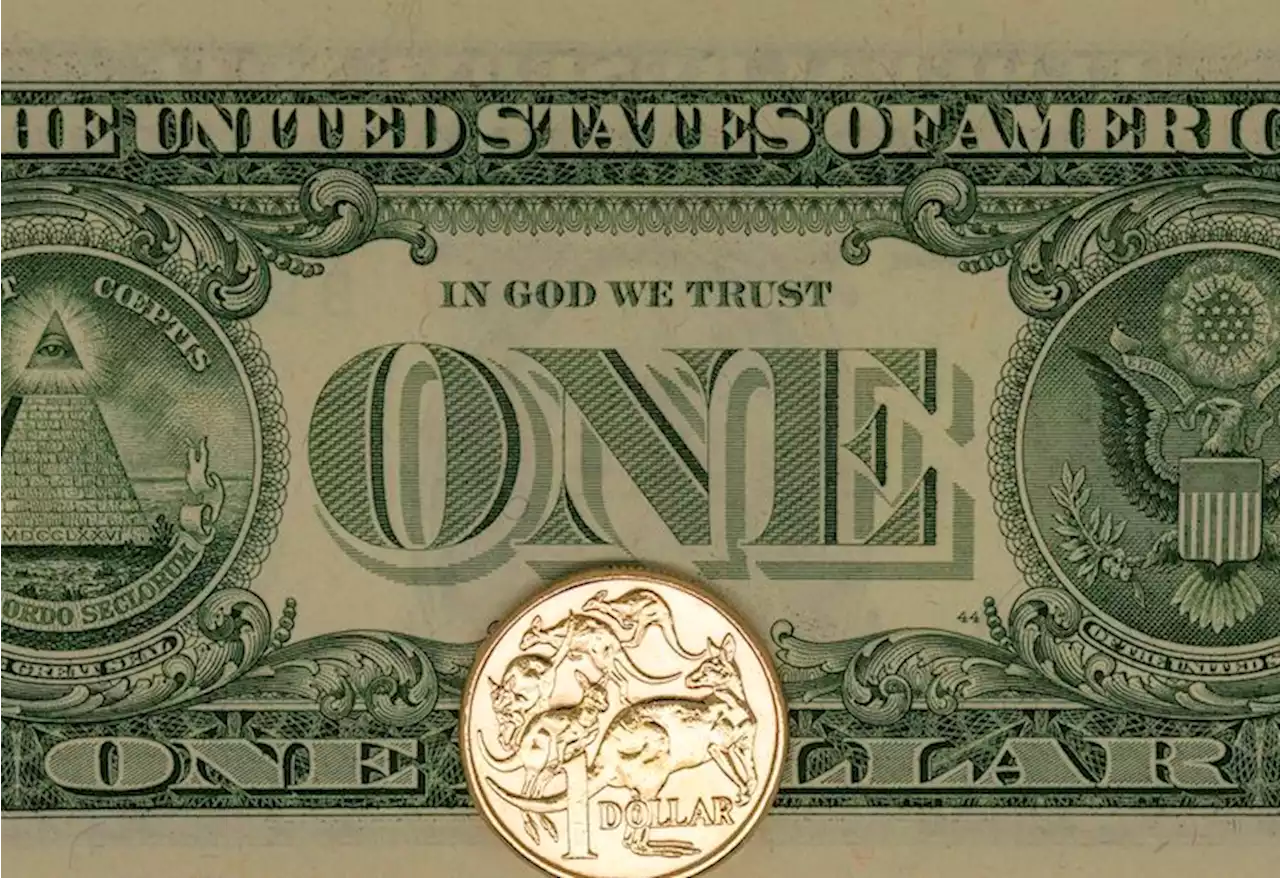

AUD/USD corrects to near two-month low around 0.6500 ahead of US/China CPI data – by Sagar_Dua24 AUDUSD Fed CPI DollarIndex Inflation

AUD/USD cracks swiftly to near a two-month low around 0.6500 amid strength in the US Dollar and China’s bleak economic growth.The Chinese economy struggles to push inflation higher due to weak domestic demand and vulnerable exports.pair witnesses a sharp correction amid strength in the US Dollar Index and a weakness in China’s business with other nations. The Aussie asset cracks to near a two-month low around 0.

S&P500 futures extend losses in the European session, portraying a buildup of caution among market participants ahead of the United States Consumer Price Index data, which will be published on Thursday. The US Dollar Index climbs above the 102.40 resistance as investors hope for stubbornness in CPI’s July reading due to a recovery in global oil prices.prices and the contribution of cheap oil to consistently softening headline price pressures would start fading.

But before that, investors will focus on China’s inflation data, which will be released on Wednesday at 01:30 GMT. Monthly CPI is expected to deliver a stagnant performance against a deflation of 0.2%. On an annual basis, inflation is expected to report a deflation by 0.5% against a neutral figure. would continue to remain in the deflation territory, however, the pace of would ease to -4% against the former release of -5.4%.

The Chinese economy struggles to push inflation higher despite monetary and fiscal stimulus due to weak domestic demand and vulnerable exports. It is worth noting that Australia is the leading trading partner of China and weak economic prospects in China impact the Australian Dollar.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

AUD/USD prints unimpressive week-start below 0.6600, Australia/US inflation clues eyedAUD/USD kick-starts the inflation week with no major changes, making rounds to around 0.6570, while defending the last two days’ corrective bounce off

AUD/USD prints unimpressive week-start below 0.6600, Australia/US inflation clues eyedAUD/USD kick-starts the inflation week with no major changes, making rounds to around 0.6570, while defending the last two days’ corrective bounce off

Baca lebih lajut »

AUD/USD sticks to gains around 0.6580, bulls seem non-committed despite softer USDThe AUD/USD pair attracts some buying for the third successive day on Monday and trades around the 0.6580 region during the Asian session. This marks

AUD/USD sticks to gains around 0.6580, bulls seem non-committed despite softer USDThe AUD/USD pair attracts some buying for the third successive day on Monday and trades around the 0.6580 region during the Asian session. This marks

Baca lebih lajut »

USD/CNH bulls attack 7.2000 as typhoon Doksuri gathers strength, US/China inflation eyedUSD/CNH bulls attack 7.2000 as typhoon Doksuri gathers strength, US/China inflation eyed – by anilpanchal7 USDCNY RiskAversion Inflation Fed China

USD/CNH bulls attack 7.2000 as typhoon Doksuri gathers strength, US/China inflation eyedUSD/CNH bulls attack 7.2000 as typhoon Doksuri gathers strength, US/China inflation eyed – by anilpanchal7 USDCNY RiskAversion Inflation Fed China

Baca lebih lajut »

AUD/USD posts modest gains around the 0.6570 mark, Australia/US inflation eyedThe AUD/USD pair kicks off the new week on a positive note and gains traction near 0.6575 during the Asian session on Monday. The uptick in the Aussie

AUD/USD posts modest gains around the 0.6570 mark, Australia/US inflation eyedThe AUD/USD pair kicks off the new week on a positive note and gains traction near 0.6575 during the Asian session on Monday. The uptick in the Aussie

Baca lebih lajut »

AUD/USD: Dwindling bets for a deeper pullback – UOBIn the view of Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group, the prospects for further decline in AUD/USD seems to be losi

AUD/USD: Dwindling bets for a deeper pullback – UOBIn the view of Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group, the prospects for further decline in AUD/USD seems to be losi

Baca lebih lajut »

AUD/USD Forecast: Long Position in Market Less AppealingAs an expert in the financial trading space, I am observing the market for signs of exhaustion that could potentially trigger a bearish move in the AUD

AUD/USD Forecast: Long Position in Market Less AppealingAs an expert in the financial trading space, I am observing the market for signs of exhaustion that could potentially trigger a bearish move in the AUD

Baca lebih lajut »