On June 30, 2022, the BIR issued Revenue Regulations 6-2022, which removed the five-year validity period on all manual and system generated principal and supplementary invoices and receipts

According to Revenue Regulations No. 18-2022, a taxpayer with expiring Authority to Print for its receipts/invoices shall apply for a new ATP not later than 60 days prior to the expiry date. The use of receipts and invoices beyond the five-year validity renders the receipts/invoices invalid.

The removal of the five-year validity period applies to taxpayers who will use principal and supplementary receipts/invoices, or those who will apply for any of the following:Registration of Computerized Accounting System /Computerized Books of Accounts and/or its componentsWhat should I do in the case of unused receipts/invoices that still have a 5-year validity period?

Taxpayers with receipts/Invoices with existing ATP expiring on or after July 16, 2022 shall continue to issue such receipts/invoices until fully exhausted. The phrase “THIS INVOICE/RECEIPT SHALL BE VALID FOR FIVE YEARS FROM THE DATE OF THE ATP” and the “Validity period” shall be disregarded. In accordance with RR No. 6-2022, the CRM/POS and/or CAS and any other machines generating receipts/invoices must undergo a configuration change until December 31, 2022.The penalty for using expired receipts/invoices is P 20,000 for the first offense and P 50,000 for the second offense.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

‘Better tax design key to funding development goals of countries like PHL’ • Cai U. OrdinarioBETTER tax design and stronger public institutions could allow emerging and low-income countries like the Philippines to finance their development goals and their climate transition, according to the International Monetary Fund (IMF). In a blog, IMF’s Director of the Fiscal Affairs Department Vitor Gaspar; Division Chief in the Fiscal Affairs Department, Mario Mansour; and Charles

‘Better tax design key to funding development goals of countries like PHL’ • Cai U. OrdinarioBETTER tax design and stronger public institutions could allow emerging and low-income countries like the Philippines to finance their development goals and their climate transition, according to the International Monetary Fund (IMF). In a blog, IMF’s Director of the Fiscal Affairs Department Vitor Gaspar; Division Chief in the Fiscal Affairs Department, Mario Mansour; and Charles

Baca lebih lajut »

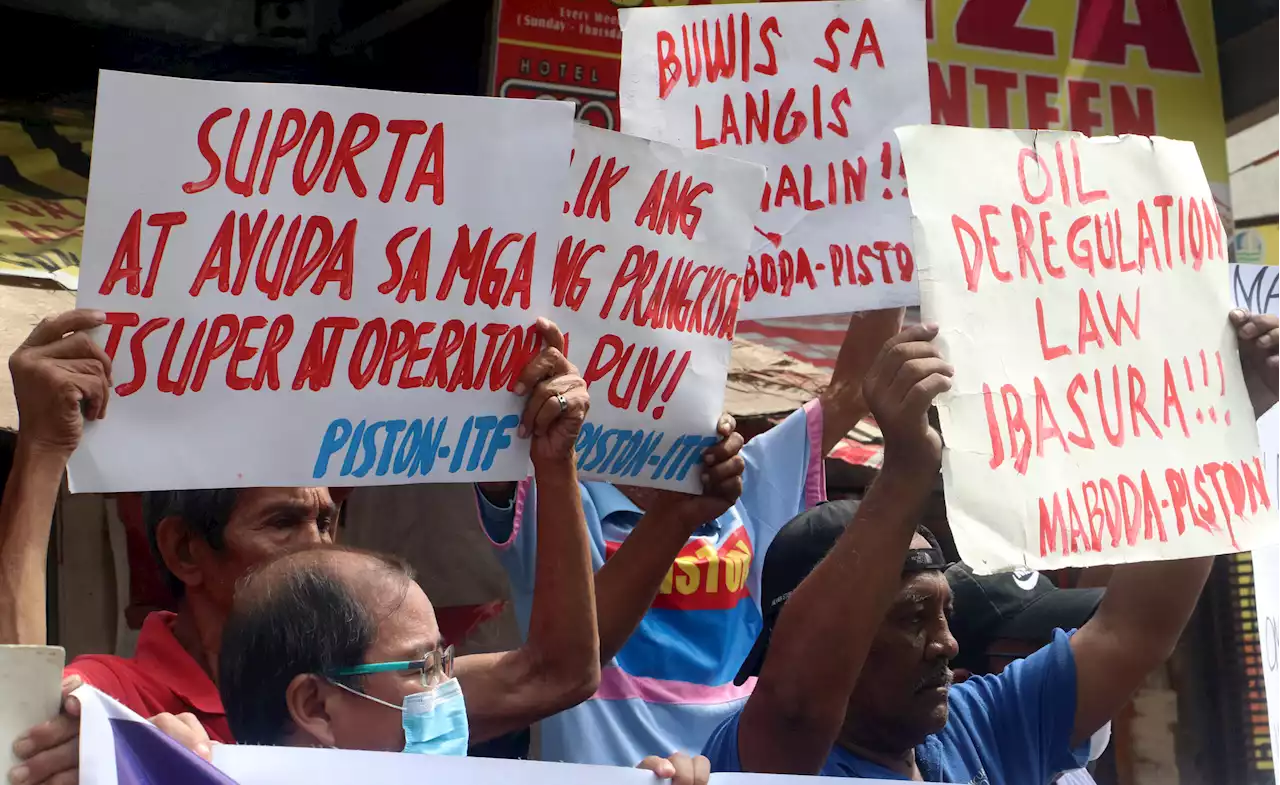

Salceda: Oil revenues give government leeway to help poor • Jovee Marie de la CruzThe House of Representatives is considering a tax approach to alleviate the impact of rising petroleum product prices. House Committee on Ways and Means Chairman Joey Sarte Salceda proposes reducing the excise tax by P3 when international oil prices exceed $80 for three months, and increasing it by P2 when prices fall below $45. While seeking to help the public, Salceda emphasizes the importance of fiscal credibility, urging caution with excise tax suspension. The chamber is exploring measures like fuel discounts for farmers, fisherfolk, and the transport sector, tapping into excess VAT revenues of P9 billion. Additionally, reducing the bioethanol requirement in gasoline to 5 percent could decrease prices by P3.1 per liter.

Salceda: Oil revenues give government leeway to help poor • Jovee Marie de la CruzThe House of Representatives is considering a tax approach to alleviate the impact of rising petroleum product prices. House Committee on Ways and Means Chairman Joey Sarte Salceda proposes reducing the excise tax by P3 when international oil prices exceed $80 for three months, and increasing it by P2 when prices fall below $45. While seeking to help the public, Salceda emphasizes the importance of fiscal credibility, urging caution with excise tax suspension. The chamber is exploring measures like fuel discounts for farmers, fisherfolk, and the transport sector, tapping into excess VAT revenues of P9 billion. Additionally, reducing the bioethanol requirement in gasoline to 5 percent could decrease prices by P3.1 per liter.

Baca lebih lajut »

Asian Games: Results, updates, and latest newsThe 19th Asian Games – postponed in 2022 by the pandemic – finally kicks off this September 23, with multiple world-class Filipino superstar athletes vying for continental supremacy

Asian Games: Results, updates, and latest newsThe 19th Asian Games – postponed in 2022 by the pandemic – finally kicks off this September 23, with multiple world-class Filipino superstar athletes vying for continental supremacy

Baca lebih lajut »

Senior citizen seeks help from ‘CIA with BA’ for unclaimed cash insuranceAling Nora took to the public service program ‘CIA with BA’ to ask for help regarding her cash insurance that

Senior citizen seeks help from ‘CIA with BA’ for unclaimed cash insuranceAling Nora took to the public service program ‘CIA with BA’ to ask for help regarding her cash insurance that

Baca lebih lajut »

EPR moratorium needed to give businesses, consumers a breather • Dr. Jesus Lim ArranzaUnder the Extended Producer Responsibility (EPR) Law of 2022 and its implementing rules issued in January, companies categorized under obliged enterprises now have to account for their plastic footprint and show proof of a minimum 20-percent recovery rate for the year 2023 or face stiff penalties. They can comply in three ways: recover on their

EPR moratorium needed to give businesses, consumers a breather • Dr. Jesus Lim ArranzaUnder the Extended Producer Responsibility (EPR) Law of 2022 and its implementing rules issued in January, companies categorized under obliged enterprises now have to account for their plastic footprint and show proof of a minimum 20-percent recovery rate for the year 2023 or face stiff penalties. They can comply in three ways: recover on their

Baca lebih lajut »

![[Ask the Tax Whiz] What do you need to know about the removal of 5-year validity of receipts/invoices?](https://i.headtopics.com/images/2023/9/22/rapplerdotcom/ask-the-tax-whiz-what-do-you-need-to-know-about-th-ask-the-tax-whiz-what-do-you-need-to-know-about-th-DC3A2EB47CB745B6127336E112FB8F3D.webp)