Following the collapse of Silicon Valley Bank and Signature Bank, small businesses owners may reconsider where to keep their money.

However, on Sunday, regulators approved a plan to ensure that clients of SVB — which just a week ago was the nation's 16th-largest bank — will get all their deposits back. The plan also applies to Signature Bank, whose customers also withdrew funds en masse.For starters, the message is that when a bank fails, customer deposits will be covered for an unlimited amount, Boneparth said.

"If you're a small business with never more than $250,000 in deposits, and your bank fails, it won't be an issue, other than a big inconvenience," Boneparth said.You also could consider having accounts at different banks, depending on the complexity of your business, said CFP Marguerita Cheng, CEO of Blue Ocean Global Wealth in Gaithersburg, Maryland.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

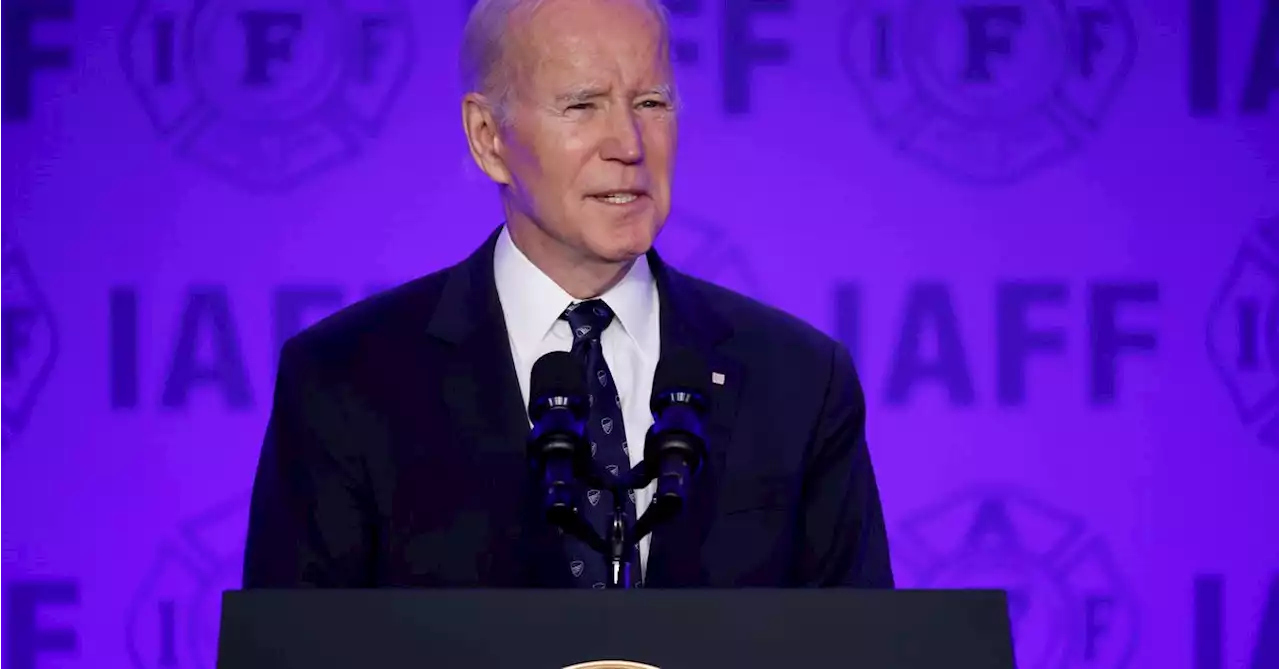

President Biden Calls for Stronger Bank Regulations in Wake of SVB, Signature Bank CollapsesWhile depositors were protected, managements and investors with collapsed lenders SVB and Signature Bank will receive no bailout, said President Biden on Monday morning. nikhileshde reports

President Biden Calls for Stronger Bank Regulations in Wake of SVB, Signature Bank CollapsesWhile depositors were protected, managements and investors with collapsed lenders SVB and Signature Bank will receive no bailout, said President Biden on Monday morning. nikhileshde reports

Baca lebih lajut »

JPMorgan, PNC among suitors for SVB Financial in deal excluding SVB Bank - AxiosJPMorgan Chase & Co and PNC Financial Service Group Inc are among those in talks about acquiring SVB Financial Group in a deal that would exclude its commercial banking unit Silicon Valley Bank that is currently under U.S. control, Axios reported on Monday citing sources.

JPMorgan, PNC among suitors for SVB Financial in deal excluding SVB Bank - AxiosJPMorgan Chase & Co and PNC Financial Service Group Inc are among those in talks about acquiring SVB Financial Group in a deal that would exclude its commercial banking unit Silicon Valley Bank that is currently under U.S. control, Axios reported on Monday citing sources.

Baca lebih lajut »

Treasury, Fed and FDIC joint statement on SVB and Signature Bank: full text'All depositors of this institution will be made whole ... no losses will be borne by the taxpayer': Read Sunday's full statement from the Treasury, Federal Reserve and Federal Deposit Insurance Corp.

Treasury, Fed and FDIC joint statement on SVB and Signature Bank: full text'All depositors of this institution will be made whole ... no losses will be borne by the taxpayer': Read Sunday's full statement from the Treasury, Federal Reserve and Federal Deposit Insurance Corp.

Baca lebih lajut »

Crypto-friendly Signature Bank shut down by regulators after collapses of SVB, SilvergateState authorities closed New York-based Signature Bank on Sunday, after Silicon Valley Bank was shut down by regulators on Friday in the biggest bank failure...

Crypto-friendly Signature Bank shut down by regulators after collapses of SVB, SilvergateState authorities closed New York-based Signature Bank on Sunday, after Silicon Valley Bank was shut down by regulators on Friday in the biggest bank failure...

Baca lebih lajut »

Regulators close Signature Bank, second shuttered by feds after SVB disasterUS regulators shut down a second bank Sunday in a bid to stem the banking crisis after Silicon Valley Bank went down last week.

Regulators close Signature Bank, second shuttered by feds after SVB disasterUS regulators shut down a second bank Sunday in a bid to stem the banking crisis after Silicon Valley Bank went down last week.

Baca lebih lajut »

US Dollar Index struggles to cheer SVB, Signature Bank news ahead of US inflationUS Dollar Index struggles to cheer SVB, Signature Bank news ahead of US inflation – by anilpanchal7 DollarIndex RiskAppetite YieldCurve Inflation NFP

US Dollar Index struggles to cheer SVB, Signature Bank news ahead of US inflationUS Dollar Index struggles to cheer SVB, Signature Bank news ahead of US inflation – by anilpanchal7 DollarIndex RiskAppetite YieldCurve Inflation NFP

Baca lebih lajut »