The 2-year Treasury yield is 'acting like a meme stock' and swinging wildly as investors see the Fed making a mistake by not cutting interest rates, says John Hancock strategist

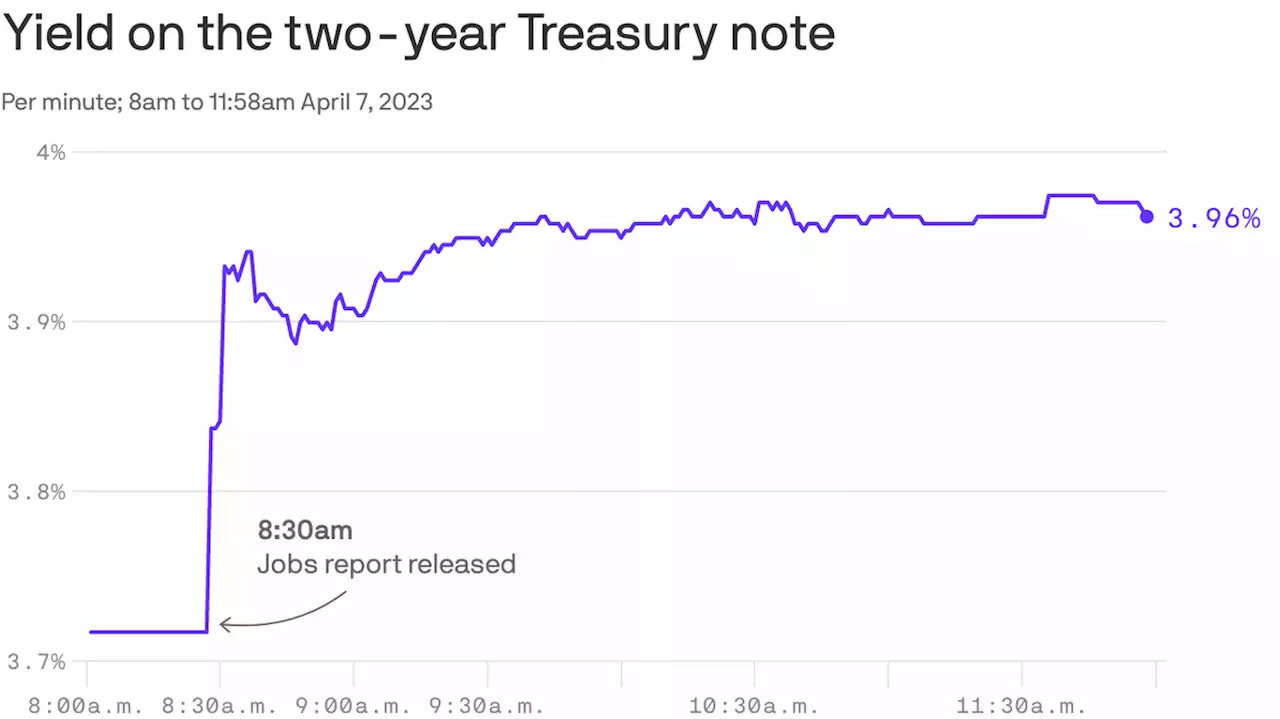

that have found favor with retail investors. But the 2-year yield — moving around 4% on Tuesday — has been on a roller coaster since early March. That yield is sensitive to expectations around Fed monetary policy.

Roland said the bond market is pricing in a May rate hike of 25 basis points, followed by three rate cuts totaling 75 basis points in 2023.

Indonesia Berita Terbaru, Indonesia Berita utama

Similar News:Anda juga dapat membaca berita serupa dengan ini yang kami kumpulkan dari sumber berita lain.

Treasury yields fall after data shows U.S. job growth slowed in MarchThe yield on the benchmark 10-year Treasury note slipped to 3.3626%, while the yield on the 30-year Treasury bond dipped to 3.5811%.

Treasury yields fall after data shows U.S. job growth slowed in MarchThe yield on the benchmark 10-year Treasury note slipped to 3.3626%, while the yield on the 30-year Treasury bond dipped to 3.5811%.

Baca lebih lajut »

Treasury yields rise on nearly perfect jobs reportYields on short-term Treasury notes, heavily influenced by expectations for what the central bank will do with monetary policy, shot higher after the jobs data was released Friday.

Treasury yields rise on nearly perfect jobs reportYields on short-term Treasury notes, heavily influenced by expectations for what the central bank will do with monetary policy, shot higher after the jobs data was released Friday.

Baca lebih lajut »

Treasury yields decline as U.S.-China tensions boost demand for bondsTreasury yields declined on Monday as renewed geopolitical tensions helped boost demand for bond-market safety plays. Bond yields move inversely to prices,...

Treasury yields decline as U.S.-China tensions boost demand for bondsTreasury yields declined on Monday as renewed geopolitical tensions helped boost demand for bond-market safety plays. Bond yields move inversely to prices,...

Baca lebih lajut »

Ethereum's 'Shapella' Upgrade Nears; U.S. Treasury Outlines Illicit Finance Risks Associated with DeFiEthereum developers have started to refer to the blockchain’s upcoming hard fork – in this case, a key upgrade – as “Shapella.” Ether Capital CEO Brian Mosoff joins the conversation ahead of the two major Ethereum network upgrades expected to occur simultaneously on April 12. Plus, TRM Labs Head of Legal and Government Affairs Ari Redbord discusses the Treasury Department's first analysis of illicit finance risks associated with DeFi.

Ethereum's 'Shapella' Upgrade Nears; U.S. Treasury Outlines Illicit Finance Risks Associated with DeFiEthereum developers have started to refer to the blockchain’s upcoming hard fork – in this case, a key upgrade – as “Shapella.” Ether Capital CEO Brian Mosoff joins the conversation ahead of the two major Ethereum network upgrades expected to occur simultaneously on April 12. Plus, TRM Labs Head of Legal and Government Affairs Ari Redbord discusses the Treasury Department's first analysis of illicit finance risks associated with DeFi.

Baca lebih lajut »

TRM Labs Exec on Future of Crypto Regulation, Treasury’s Warning on DeFiThe U.S. Treasury Department is out with a new report warning that decentralized finance (DeFi) services that aren’t compliant with anti-money laundering and terrorist financing rules pose “the most significant current illicit finance risk” in that corner of the crypto sector. TRM Labs Head of Legal and Government Affairs Ari Redbord breaks down the Treasury Department's first analysis of hazards in the DeFi space. Plus, his outlook on the crypto regulatory framework in the U.S.

TRM Labs Exec on Future of Crypto Regulation, Treasury’s Warning on DeFiThe U.S. Treasury Department is out with a new report warning that decentralized finance (DeFi) services that aren’t compliant with anti-money laundering and terrorist financing rules pose “the most significant current illicit finance risk” in that corner of the crypto sector. TRM Labs Head of Legal and Government Affairs Ari Redbord breaks down the Treasury Department's first analysis of hazards in the DeFi space. Plus, his outlook on the crypto regulatory framework in the U.S.

Baca lebih lajut »

ROOK Token Surges Ahead of $50M Treasury Split Between Community and MEV Tech BuildersA proposal would divvy up Rook’s nearly $50 million crypto treasury between Rook Labs, which builds MEV technology, and the new Incubator DAO.

ROOK Token Surges Ahead of $50M Treasury Split Between Community and MEV Tech BuildersA proposal would divvy up Rook’s nearly $50 million crypto treasury between Rook Labs, which builds MEV technology, and the new Incubator DAO.

Baca lebih lajut »